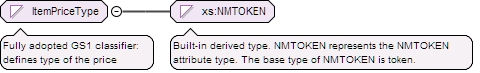

<xs:simpleType name="ItemPriceType">

<xs:annotation>

<xs:documentation>Fully adopted GS1 classifier: defines type of the price</xs:documentation>

</xs:annotation>

<xs:restriction base="xs:NMTOKEN">

<xs:pattern value="ALLOWANCE"/>

<!-- Credit reflected on an invoice. This can occur either at the item or the invoice level. There are many types of allowances. Some are contractually based, e.g. backhaul, others are not formalized contracts. Some allowances are offered to the industry such as payment terms while others such as promotional allowances are trading partner specific. -->

<xs:pattern value="BRACKET_TIER_PRICE"/>

<!-- The price associated with an item for the purchase of a specific number of trade items, or some other logistical measure (weight, cube, truck). These are often offered in a series (e.g. 100 to 299 case lots, 300 to 599, full truckload, half truckload; each offering a different discount). -->

<xs:pattern value="CHARGE"/>

<!-- Debit reflected on an invoice. This can occur either at the item or at the invoice level. There are many types of charges. Some are contractually based, others are not formalized contracts. -->

<xs:pattern value="CONTRACT_PRICE"/>

<!-- The price associated with an item exclusive of all allowances, charges, taxes and customs duty. (May or may not be customer specific). This applies to imported items that upon arrival into the country are stored in a Customs bonded warehouse. The goods are then sold without the customs duty paid. The purchaser must pay the customs duty. -->

<xs:pattern value="DECLARED_CUSTOMS_VALUE"/>

<!-- This is the value of the item as declared by the supplier. This value is used by customs to calculate the customs duty that is payable. -->

<xs:pattern value="INTRODUCTORY_PRICE"/>

<xs:pattern value="LIST_PRICE"/>

<!-- External price associated with a product absent of all allowances or charges. This is normally the printed price contained on supplier’s price list or catalogue. (May or may not be customer specific). -->

<xs:pattern value="OTHER"/>

<xs:pattern value="PROMOTIONAL_PRICE"/>

<xs:pattern value="RETAIL_PRICE"/>

<xs:pattern value="TRANSACTION_PRICE"/>

<!-- price shown on the invoice document, including allowances and/or charges applying to the trading partner relationship (which can be zero), but excluding VAT and any other taxes, fees, and/or duties.-->

<xs:pattern value="TRANSACTION_PRICE_WITH_SPECIAL_TAXES"/>

<xs:pattern value="TRANSACTION_PRICE_WITH_VAT_AND_SPECIAL_TAXES"/>

<xs:pattern value="UNDERBOND_LIST_PRICE"/>

<!-- The price associated with an item exclusive of all allowances, charges, taxes and customs duty. (May or may not be customer specific). This applies to imported items that upon arrival into the country are stored in a Customs bonded warehouse. The goods are then sold without the customs duty paid. The purchaser must pay the customs duty.-->

<xs:pattern value="UNDERBOND_TRANSACTION_PRICE"/>

</xs:restriction>

</xs:simpleType>

|